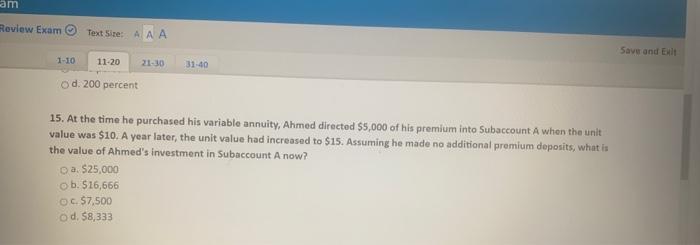

At the time he purchased his variable annuity ahmed – At the time he purchased his variable annuity, Ahmed faced a complex financial landscape. This analysis delves into the intricacies of his investment decision, exploring the market conditions, investment strategy, and implications of his choice.

Ahmed’s variable annuity offered a unique blend of features and benefits, tailored to his specific financial goals. The investment options available within the annuity provided him with a range of choices to align with his risk tolerance and time horizon.

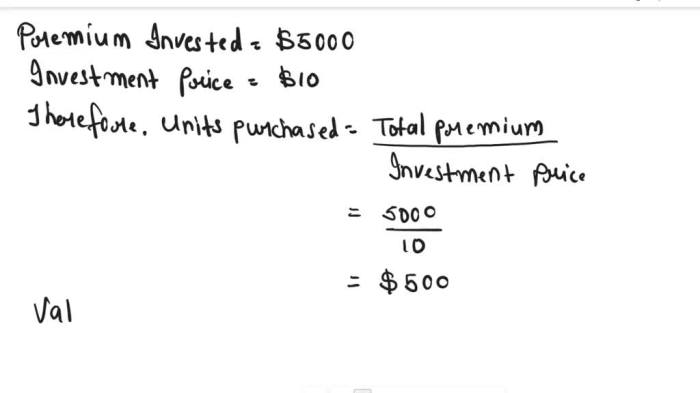

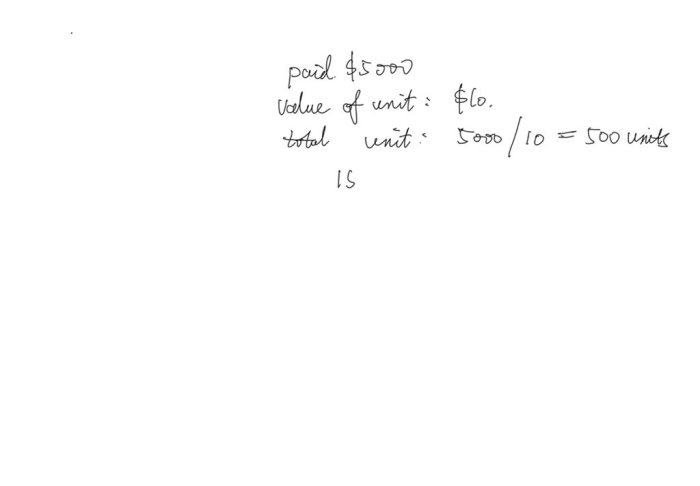

Ahmed’s Variable Annuity

A variable annuity is a type of investment contract that offers a stream of income payments, with the value of the underlying investments fluctuating based on market performance. Variable annuities provide investors with the potential for higher returns than traditional fixed annuities, but they also carry more risk.

Ahmed’s variable annuity offers a range of investment options, including stocks, bonds, and mutual funds. The annuity also provides a guaranteed minimum withdrawal benefit, which ensures that Ahmed will receive a certain amount of income each year, regardless of market conditions.

Investment Options

- Stocks: Stocks represent ownership in a company and offer the potential for high returns, but also carry more risk.

- Bonds: Bonds are loans made to companies or governments and offer lower returns but are generally considered less risky than stocks.

- Mutual funds: Mutual funds are professionally managed investment funds that pool money from multiple investors and invest in a variety of assets, such as stocks, bonds, and commodities.

Market Conditions at the Time of Purchase

At the time Ahmed purchased his variable annuity, the financial market conditions were favorable. The stock market was performing well, and interest rates were low. This made it an attractive time to invest in variable annuities, as the potential for high returns was greater than the risk of losing money.

Stock Market Performance

The stock market had been on a bull run for several years, and the S&P 500 index had reached record highs. This strong performance was driven by a number of factors, including low interest rates, strong corporate earnings, and a positive economic outlook.

Bond Market Performance

The bond market was also performing well, with interest rates at historically low levels. This made bonds an attractive investment for investors seeking a safe haven for their money.

Ahmed’s Investment Strategy

Ahmed’s investment goals were to generate income and preserve capital. He was willing to take on some risk in order to achieve these goals, but he was not comfortable with the high risk associated with investing in stocks. As a result, he decided to invest the majority of his money in bonds and mutual funds.

Risk Tolerance

Ahmed’s risk tolerance was moderate. He was comfortable with the potential for some losses, but he did not want to risk losing a significant portion of his savings.

Time Horizon, At the time he purchased his variable annuity ahmed

Ahmed’s time horizon was long-term. He was planning to retire in 10 years, and he wanted his investments to continue to grow during that time.

Helpful Answers: At The Time He Purchased His Variable Annuity Ahmed

What is a variable annuity?

A variable annuity is a type of investment contract that provides a stream of income in retirement. The value of the annuity fluctuates based on the performance of the underlying investments.

What are the benefits of a variable annuity?

Variable annuities offer potential for growth, tax-deferred earnings, and a guaranteed income stream in retirement.

What are the risks of a variable annuity?

Variable annuities are subject to market risk, which means the value of the annuity can fluctuate. Additionally, there may be fees and expenses associated with the annuity.