Prepare an income statement for the month of June, a crucial financial document that provides a snapshot of a company’s financial performance, takes center stage in this comprehensive guide. This detailed analysis will delve into the intricacies of crafting an accurate and informative income statement, empowering readers with the knowledge and skills to effectively evaluate a company’s financial health.

By exploring revenue streams, categorizing expenses, calculating net income, and presenting the results in a clear and concise format, this guide will equip readers with the tools necessary to gain valuable insights into a company’s financial position.

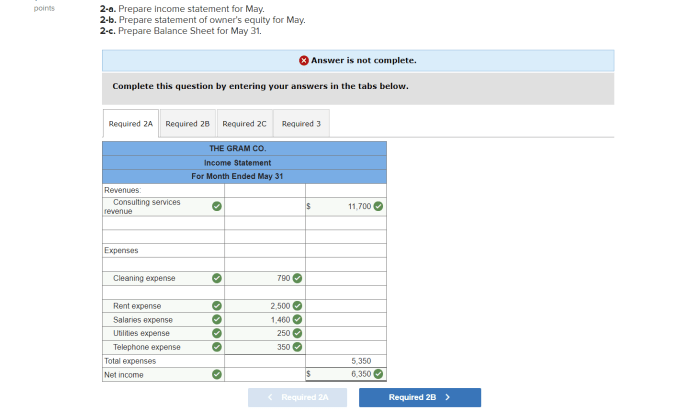

Income Statement for June

An income statement provides a comprehensive overview of a company’s financial performance during a specific period, typically a month or a quarter. It Artikels the revenue generated, expenses incurred, and net income earned by the company. By analyzing the income statement, stakeholders can gain valuable insights into the company’s financial health and profitability.

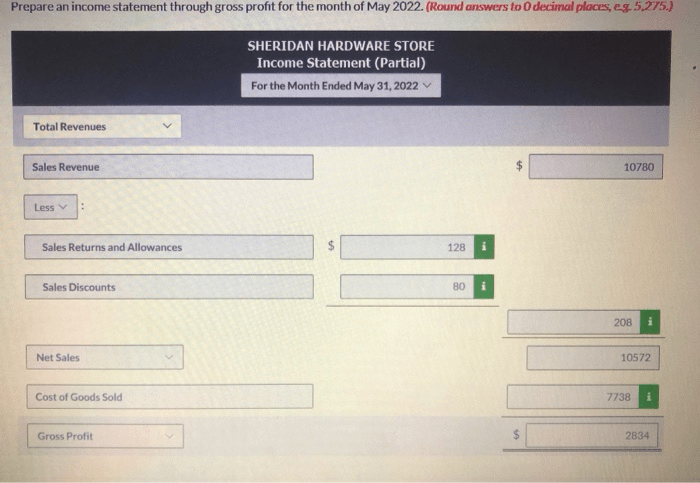

Revenue, Prepare an income statement for the month of june

Revenue represents the total income generated by a company from its core business activities. It can be derived from various sources, such as sales of products or services, interest earned on investments, or rental income from properties. The calculation of revenue involves identifying all sources of income and summing them up.

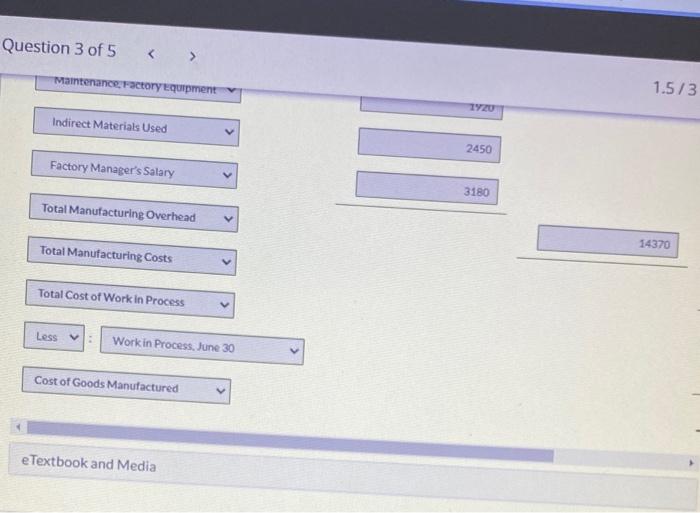

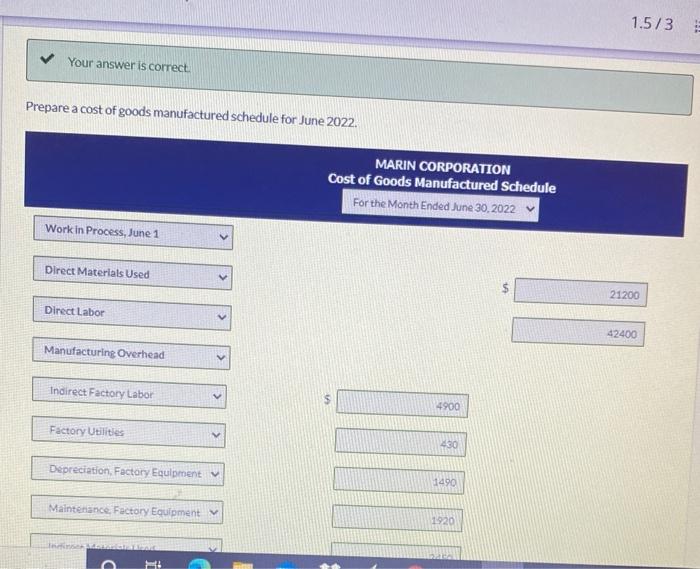

Expenses

Expenses are the costs incurred by a company in the course of generating revenue. They can be categorized into various types, including:

- Cost of Goods Sold (COGS): This expense represents the direct costs associated with producing or acquiring the goods or services sold.

- Operating Expenses: These expenses include administrative costs, such as salaries, rent, and utilities, as well as marketing and advertising costs.

The calculation of expenses involves identifying all relevant costs and allocating them to the appropriate categories.

Net Income

Net income, also known as profit, is calculated by deducting total expenses from total revenue. It represents the company’s earnings after accounting for all expenses incurred. Factors that impact net income include changes in revenue, cost structure, and operating efficiency.

Financial Position

The income statement provides valuable insights into a company’s financial position. The following table summarizes the income statement for June:

| Category | Amount |

|---|---|

| Revenue | $100,000 |

| Cost of Goods Sold | $50,000 |

| Operating Expenses | $20,000 |

| Net Income | $30,000 |

The income statement indicates that the company generated $100,000 in revenue in June. After deducting $50,000 in COGS and $20,000 in operating expenses, the company earned a net income of $30,000. This information provides stakeholders with a clear understanding of the company’s financial performance during the month.

Answers to Common Questions: Prepare An Income Statement For The Month Of June

What is the purpose of an income statement?

An income statement provides a summary of a company’s financial performance over a specific period, typically a month or quarter.

What are the key components of an income statement?

The key components of an income statement include revenue, expenses, and net income.

How is net income calculated?

Net income is calculated by subtracting total expenses from total revenue.